You can check your your Active Fbr Filer Status or Active Taxpayer Status through online and manually through SMS service.

Check ATL Status through Online Method:

For online status check, you can check your FBR filer status by simply going to Online Active Taxpayer Status and follow the steps:

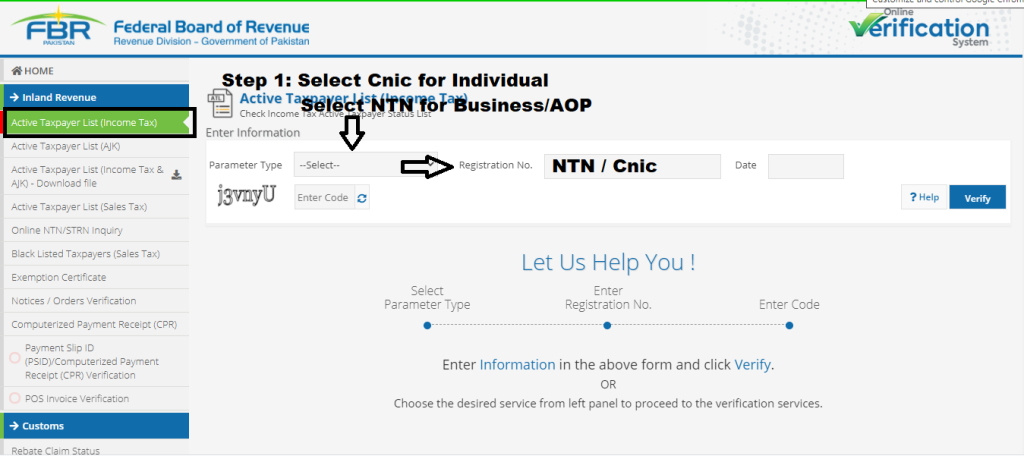

Step 1: Under Parameter type select NTN if taxpayer is Business or AOP. If taxpayer is individual you will have to select CNIC option. Enter Cnic no or NTN in Registration No. field according to parameter selected. (The value must be added without hyphen).

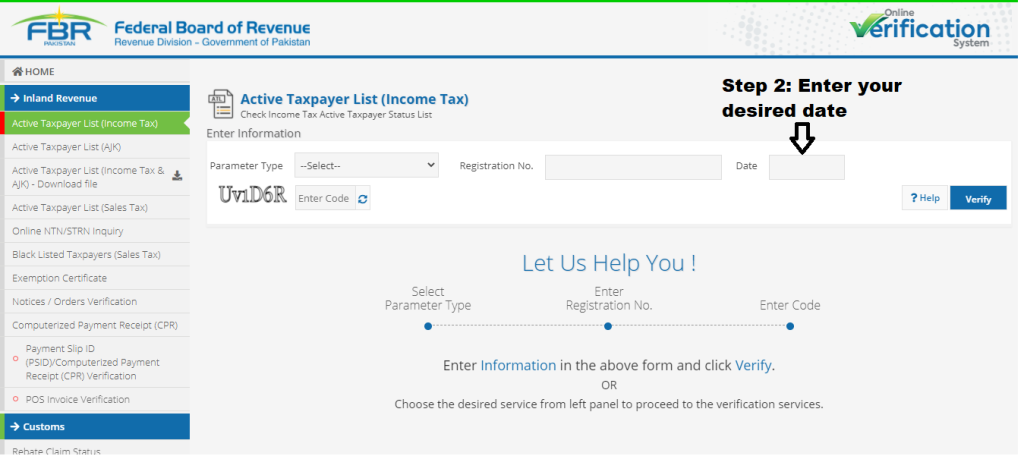

Step 2: Under Date field, you can select any previous date to check your ATL status for desired date.

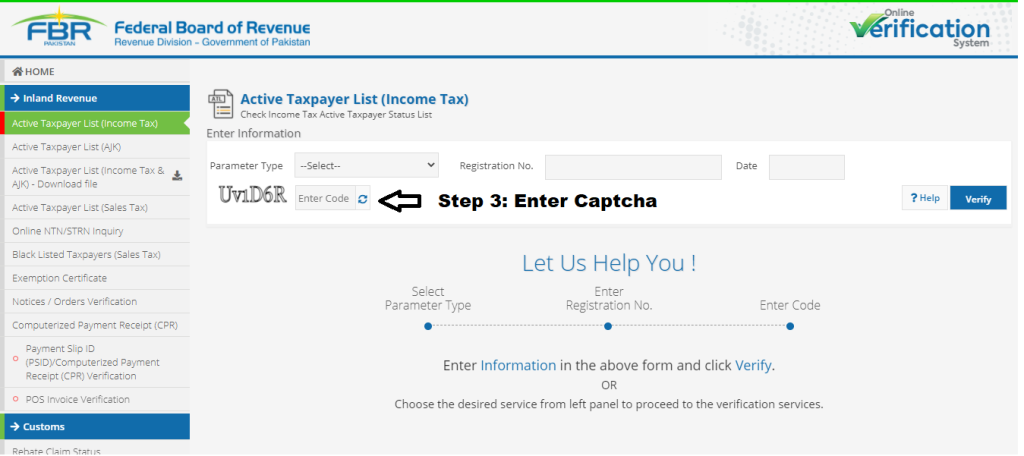

Step 3: Enter captcha code under Enter code field.

After providing all details, click on the Verify button to see the results. After successful verification, result will be displayed on your screen.

Check ATL Status through SMS

In order to check you ATL status, you will have to perform the following simple steps:

- For individual: Type in message on your phone “ATL (space) 13 digits Computerized National Identity Card (CNIC)” and send to 9966.

- For Company or AOP: Type “ATL (space) 7 digits National Tax Number (NTN)” and send to 9966.

Check AJ&K Active Taxpayer status by SMS through the following procedure:

- For any Individual person, you need to type AJKATL (space) CNIC and send it to 9966. The CNIC number shouldn’t have spaced inserted.

- The person having should type NTN AJKATL (space) 11 digit NTN number and send it to 9966. Also, NTN number shouldn’t have any space inserted between digits.

Check ATL Status by downloading ATL list:

For updated, active taxpayer list please click on the link given:

52 responses to “How to check FBR filer status in Pakistan?”

ALT 3750515043983

Cnlc no FBR Chek

Please provide us with your CNIC No so that we may check your FBR Filer Status.

Kindly check my online filer/non-filer status for year 2020-21

My CNIC no is 17301-3776290-3

You filer status is active.

Please let me know your cnic no.

ALT 3520225360695

3520096806071

In-Active

34301-2624468-2

Please send me filer status which i have to submit to the educational institute to avoid double deduction of income tax.

Like!! Great article post.Really thank you! Really Cool.

Please Check my filer Status

5440139168623

You status is inactive and you are non-filer.

Plz send my ATL no

You are requested to please email us your CNIC no so that we may check your ATL no.

ATL 3740545033917

SMS is not working.

Please check my status.

Thanks

Your ATL Status is active.

Admin, please check my filer status

CNIC # 42301-8858718-5

Thanks

No record found against your CNIC number. You can be a filer but it looks you didn’t get your NTN number.

I am an overseas Pakistani, planning to be a filer

I have no business income in Pak

Can you please guide me to be a filer ?

Yes, you can contact us on Whatsapp no +923335128026 so that we may guide you properly.

Admin, please check my filer status

cnic 4140994681249

Admin, please check my filer status

CNIC # 41409-9468124-9

Thanks

Adhmed Sadiq Palijo, Registration No: 4140994681249, ATL Status: InActive (Non-filer).

*ALT 3520226824519

sir plez check my filer stuts

plez check my filer stutes

3130321357997

ATL status is Active

Please send me filer status which i have to submit to the educational institute to avoid double deduction of income tax.

Please let us know your CNIC No so that we may check your Filer status.

Please provide filer status

Please check my filer status for purpose Bank Transaction

4220137195323

Your filer status is active.

my ntn number is 2220008-8 I want to know I am filer or not

Your filer status is not active.

FBR

I have NTN and submitted 3 forms for 2017,18 and 19. I am non resident Pakistani with no income source within Pakistan. How can I get Filer status

Yes, you can enroll yourself as filer by visiting FBR web portal.

This is my CNIC NO# 34603-7480872-5 please check and let me know If I’m filler or not. Thanks

Your filing status is active.

Year 2019

2019 Year return file

Please let me know your query in detail.

In-Active Note: In case you have not yet filed Income Tax Return-2019, please file now. In case you have filed Income Tax Return after due date, please pay surcharge for inclusion of name in ATL. Surcharge rate (IND: Rs. 1,000, AOP: Rs.10,000, COY: Rs.20,000) ALT 1430176742913. Please check my status and let me know that why it is inactive because i already had done my filing and i was waiting for monday because list is updated on Monday but here again my name is not in active list.

3830165177525

login problem and showing

“In-Active”

what i have to do for get login to fbr site.

You need to register yourself on the iris portal.

Kindly check my filer status

34301-2624468-2

Registration No: 3430126244682

Name: SHAHZADA BEGUM

Business Name: SHAHZADA BEGUM

Filing Status: Active

Filing Status Checking Date: 22-Mar-2021

My cnic no 4240126521153,Please provide my filer status. Regards.

Registration No: 4240126521153

Name: MUHAMMAD KAMAL SIDDIQUI

Business Name:

Filing Status: Active

Filing Status Checking Date: 26-Mar-2021