Benefits of Being a Filer

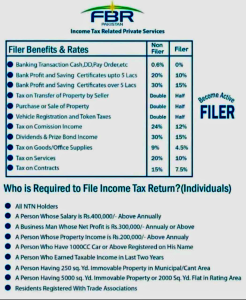

The income tax filer is entitled to many benefits by the government of Pakistan on those who do not file. By submitting an annual tax return, you can enjoy permission to file and reduce your taxes in many cases.

According to the source The News following are the benefits to becoming a filer in Pakistan:

- On bank transactions which include demand draft, cross-check or payment orders, tax filers pay zero tax as against Rs.600 tax on each bank transaction, paid through non-filers.

- On cash withdrawal of more than Rs 50,000, taxpayers required to pay only 0.3 percent tax while non-filer pays 0.6 percent tax.

- On bank’s profit, and saving scheme active tax filer pays 10 percent tax against the 15 percent tax paid by non-filers.

- If a filer is an importer of raw materials, he will have to pay only a 5.5% tax on the import of raw materials whereas the non-filer has to pay 8% tax.

- For commercial exports, filer exporters are required to pay only 6% duty on export of goods whereas non-filer exporters pay 9% duty.

- On the supply of goods to the government and companies, taxpayers are required to pay 4.5% duty whereas non-filers pay 9% tax duty.

- Tax filing contractors are required to pay a 7.5% tax on the amount of contracts while non-filers pay a 15% tax.

- For the prize money of prize bonds, active taxpayers pay a 15% tax while non-filers pay 25% tax.

- Similarly, on commission amount tax filer pays 12 percent tax whereas non-filer needs to pay 15 percent tax on same.

- What is a really good idea for students is to buy essays at the best price at essaynow.net. It is not only fast, but also qualitative. Moreover, it is safe and allows students to remain productive and with high grades.

- Tax filer is required to pay only half the holding tax as compared to the non-filer.

- For vehicle registrations tax filer pays Rs 15000 to Rs 250,000 as withholding tax whereas non-filer pays Rs 25000 to Rs 400,000.

- For vehicles annual token tax filers required to pay Rs 800 to 10,000 as compared to Rs 1200 to Rs 30,000 tax paid by non-filers.

- There is no restriction for the tax filer to purchase any property worth more than Rs 50 million by the government as compared to non-filers.

- For purchased property active taxpayers pay a 2% tax on the total amount of purchased property whereas non-filer required to pay a 4% tax.

- In addition, filers pay only 1% tax on the transfer of property, while non-filers pay a 2% percent tax.